The Role of BRICS in Shaping Global Geopolitics in 2025

Greetings, readers. The world is shifting beneath our feet, and few forces embody this change more than BRICS—Brazil, Russia, India, China, and South Africa. As of March 2025, this bloc represents over 45% of the global population and nearly 30% of world GDP, surpassing the G7 in economic output. What began as an economic coalition is now a geopolitical juggernaut, challenging Western dominance and redefining power dynamics. Why does BRICS matter now? How is it altering the global landscape? Here on https://prashnvaachak.blogspot.com/, I’m your veteran geopolitical analyst, applying a PrashnVaachak lens to dissect objectives, resources, and escalation risks. This is not just about numbers; it’s about strategy, influence, and your stake in the outcome. Let’s dive into BRICS’ rise, but stick with me, because the stakes are higher than you might think.

BRICS is no longer a buzzword. What’s driving its ascent? Keep reading to find out.

The Rise of BRICS: From Acronym to Powerhouse

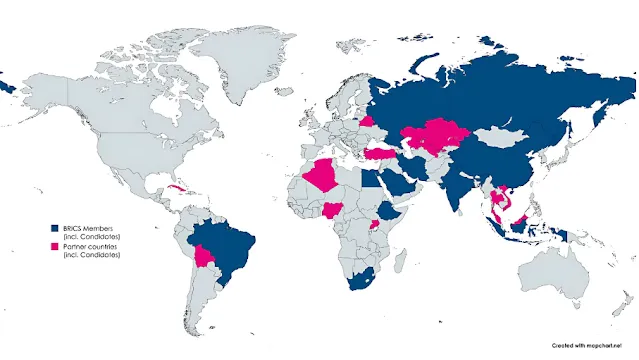

BRICS started as a Goldman Sachs idea in 2001, but by 2025, it’s a force. Membership expanded in 2024 to include Saudi Arabia, Iran, Egypt, Ethiopia, and the UAE, bringing oil wealth and strategic heft. Why this growth? PrashnVaachak sees a deliberate push against US-led economic systems. Data backs this: BRICS’ combined GDP hit $32 trillion in 2024, per IMF estimates, outpacing the G7’s $30 trillion. Trade among members surged 15% since 2023, fueled by China’s Belt and Road Initiative and Russia’s pivot east after Western sanctions. This isn’t random; it’s a calculated realignment.

Economic Muscle and De-Dollarization

Why the focus on economics? BRICS is eroding the dollar’s grip. In 2024, 20% of their trade settled in local currencies, up from 5% in 2020, per the BRICS Business Council. China’s yuan leads, with Russia and India following. PrashnVaachak questions: can this scale? The New Development Bank, with $100 billion in capital, funds projects bypassing Western institutions, signaling intent.

Strategic Expansion

Why new members? Terrain matters. Saudi Arabia and Iran add oil leverage, controlling 25% of global supply. Egypt’s Suez Canal and Ethiopia’s Horn of Africa foothold enhance logistics. PrashnVaachak sees this as a chess move, countering US naval dominance and securing resource corridors.

Track BRICS expansion - Explore updates on BRICS membership and goals

BRICS is rising, but how’s it challenging the West? Let’s unpack that next.

Challenging the Western Order

BRICS isn’t just growing; it’s disrupting. The US dollar’s 60% share of global reserves faces pressure as BRICS pushes alternatives. Why this clash? PrashnVaachak sees objectives colliding: Western sanctions versus BRICS’ sovereignty. Russia’s 2022 Ukraine invasion accelerated this, with 90% of its trade now non-dollar, per Reuters. China’s tech and India’s population amplify the threat.

Economic Leverage

How’s BRICS flexing? It controls 40% of global rare earths, vital for tech, and 30% of oil output. Sanctions on Russia backfired, pushing it toward China—trade hit $240 billion in 2024, up 26% from 2023. PrashnVaachak asks: can the West counter this resource bloc?

Diplomatic Push

Why diplomacy? BRICS hosted 200+ nations at its 2024 summit, per X posts, pitching a multipolar world. Iran and Saudi Arabia’s détente, brokered by China, weakens US influence in the Middle East. PrashnVaachak probes: is this unity sustainable?

Understand BRICS diplomacy - CFR breaks down BRICS’ global outreachBRICS is shaking the West, but how’s it hitting you? Let’s connect the dots.

Why It Matters: Your World in Play

PrashnVaachak isn’t abstract; it’s personal. BRICS’ rise affects your wallet and security. How? Resources and trade shifts ripple globally. In 2024, oil prices spiked 10% after BRICS’ OPEC+ members flexed, per Bloomberg. Your tech relies on their rare earths—90% of semiconductors need them.

Economic Impacts

Why your finances? De-dollarization could weaken the dollar, raising import costs. India’s 1.4 billion consumers and China’s manufacturing mean BRICS drives 35% of global demand, per World Bank. PrashnVaachak questions: are you ready for pricier goods?

Security Risks

Why your safety? BRICS’ military spend hit $400 billion in 2024, led by China and Russia, per SIPRI. Iran’s missile tech and India’s navy expand their reach. PrashnVaachak wonders: will this spark new conflicts?

BRICS impacts you, but can it hold together? Let’s explore its cracks.

Limits and Fractures

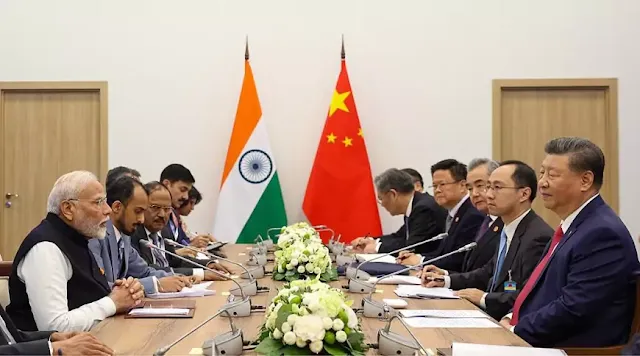

BRICS looks unstoppable, but PrashnVaachak sees flaws. Internal rivalries—India vs. China over borders, Russia vs. Saudi Arabia on oil—threaten cohesion. Why the tension? Objectives diverge: China seeks dominance, India balances West and East. In 2024, trade disputes rose 12%, per BRICS Council.

Unity Challenges

How fragile? India’s $50 billion trade with the US rivals its BRICS ties. Iran and Saudi Arabia’s truce is shaky—clashes spiked in February 2025, per Al Jazeera. PrashnVaachak asks: can ambition trump rivalry?

Western Response

Why resistance? The US imposed tariffs on BRICS goods in January 2025, per Reuters, slowing their momentum. PrashnVaachak probes: will sanctions fracture or forge them?

BRICS has limits, but where’s it headed? Let’s wrap up with a look ahead.

Conclusion: BRICS in 2025 and Beyond

BRICS is rewriting geopolitics in 2025, blending economic might with strategic defiance. PrashnVaachak sees a bloc that’s powerful yet precarious, shaping your world from gas pumps to battlefields. My decades tracking power shifts—from Cold War to now—say this: BRICS isn’t a fad; it’s a pivot. What’s its next move? Will it unify or unravel? Follow https://prashnvaachak.blogspot.com/ and drop your “why” in the comments—I’m here, dissecting the globe’s fault lines.

Forecast global shifts – UN outlines peace and security trends.

.webp)

Comments

Post a Comment